This investment style may have been mentioned to you and you didn’t really know what it meant but also didn’t want to ask. It is a quite common way of investing, so I’ll try and explain it to you.

To answer this question we first need to touch on passive vs. active investments.

The quickest and easiest way to explain the difference is that Actively managed funds have someone behind the scenes pulling the strings (deciding on what to invest in) which means they generally cost more. Passive is the opposite, they are simply a low-cost index following fund.

Now, to the nitty gritty.

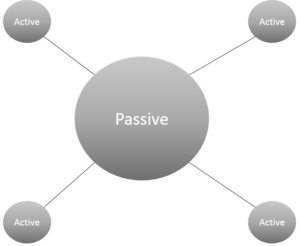

A core satellite is in essence a breakdown of active and managed funds. Generally, the largest, core, is your passive investments, and the smaller, satellites are the active funds. Here is a very professional graph I made in PowerPoint to try and visualize it a bit:

The reason for this is because active funds are generally more expensive and there is no guarantee they are going to outperform a cheaper passive fund.

This is why core satellites are so common, it’s an attempt to try and have the “best of both worlds.” You can spend most of your money in the cheaper index fund and take a chance with some satellites.

With the help of one of our financial advisers, we can help make the decisions on what passive and active funds to use, as there are a LOT to choose from. As well as help change them if need be.