Boost your spouse’s super and reduce your tax

Making an after-tax contribution to your spouse’s super could benefit you both – by increasing your spouse’s super and potentially reducing your tax. How does the strategy work?If you make an after-tax contribution into your spouse’s super account and they earn less than $40,000 in FY 2022/23, you may be eligible for a tax offset of up […]

Splitting your super contributions to your spouse

Splitting super contributions to your spouse’s super account may help boost their retirement savings and provide a range of other benefits. How does the strategy work? You may be able to split (transfer) eligible concessional contributions (CCs) that you’ve made or received to your spouse’s super account. Eligible CCs include employer super contributions and personal super contributions […]

Top-up your super with help from the Government

If your income is under a certain threshold, then making personal after-tax super contributions could enable you to qualify for a Government co-contribution and take advantage of the low tax rate payable in super on investment earnings. How does the strategy work?If you earn¹ less than $57,016 pa (of which at least 10% is from eligible employment […]

Topping up super with ‘catch-up’ contributions

If you have not fully used your concessional cap in a prior financial year, you may be eligible to use these unused carried-forward amounts in a later year. Depending on your circumstances, this could help you to maximise tax-effective super contributions and invest more for retirement. How does the strategy work? If your concessional contributions (CCs) in […]

Smart Super Strategies for this EOFY

With June 30 fast approaching, it’s time to start thinking about your super for another year. We’ve put together five smart strategies that may benefit you now, and help boost your super. Strategy This may be right if you … How to use this strategy The benefits may include 1. Add to your super and get a […]

Make Tax-Deductible Super Contributions

By making a personal super contribution and claiming the amount as a tax deduction, you may be able to pay less tax and invest more in super. How does the strategy work? If you make a personal super contribution, you may be able to claim the contribution as a tax deduction and reduce your taxable income. The […]

Federal Budget May 2023 Summary

The 2023 Federal Budget focuses on providing cost of living relief through lower power bills, higher welfare payments and more support for small business and housing. Note: These changes are proposals only and may or may not be made law. Cost of living Energy bill relief: An electricity bill credit of up to $500 will […]

A lot can happen in a year

This time 12 months ago, I had just finished up with my previous employer and was on holiday with my family in preparation to take a leap of faith of sorts. My first day with BW Private Wealth was still a couple of weeks away and I was quite nervous about what was to come. […]

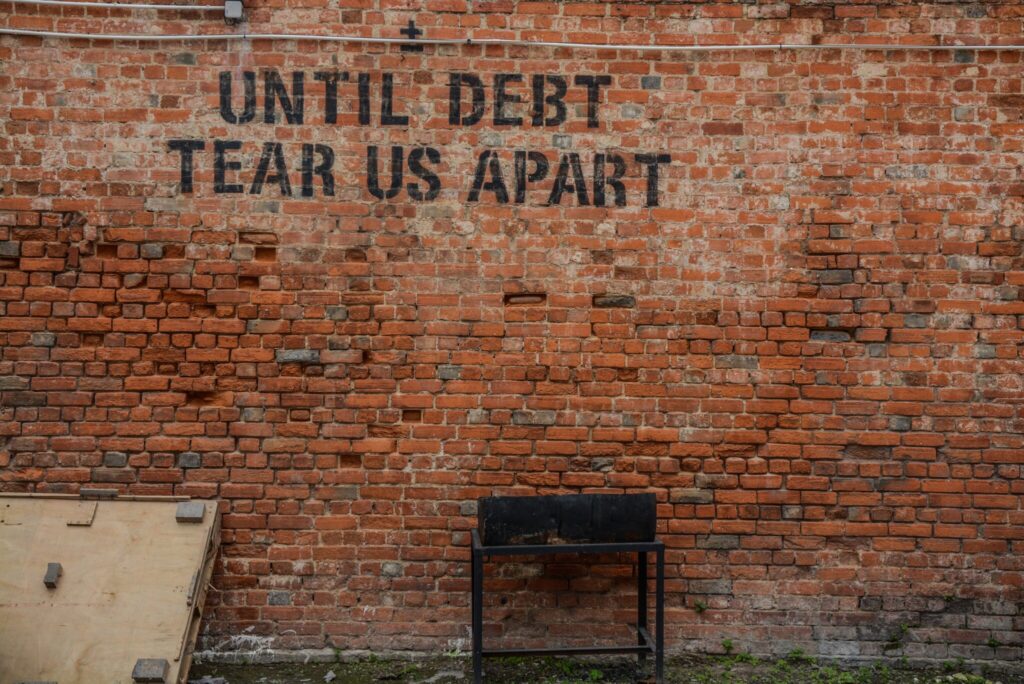

Good Debt vs. Bad Debt

With interest rates on the rise, although we have recently seen CBA reduce their fixed rate which is generally a good indicator that we might get some reprieve on our interest rates, debt has become a large talking point. I have had a few people over the last couple of months talk about salary sacrificing vs. paying […]

Celebrate the wins!

This is something that I do myself and it really helps to keep me motivated. Whether it be paying down debt, staying within a budget, or building up savings, you really need to celebrate those wins. And don’t set the bar too high, don’t save the celebration until the mortgage is paid off! If you […]